The future of logisitics, transport and supply chain

There many reasons why the logistics and transportation sector is actively embracing automation technologies and systems.

If leveraged properly, they can enable more efficient and accurate operations, thus reducing errors and improving overall productivity. Further, technologies also unlock opportunities for real-time tracking and greater optimisation of transportation routes, leading to cost savings and better asset utilisation.

Safety is another key benefit. By eliminating human errors and fatigue, automation can ultimately contribute to a more reliable and secure supply chain.

Transportation

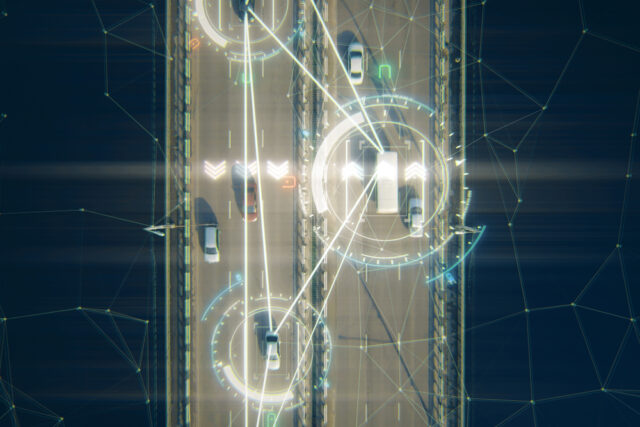

Autonomous vehicles and drones are poised to revolutionise last-mile delivery, providing faster and more flexible options for consumers. Indeed, as the demand for faster and more reliable logistics services continues to grow, the value proposition of automation becomes increasingly compelling for businesses in this sector.

Although we don’t like to speak of automation taking human jobs, in some cases it is becoming an increasingly viable solution for bridge the gaps that have emerged from chronic labour shortages.

Workforce

Drivers stand as a prime example. According to a study CILT UK completed in June 2022, around six in 10 organisations are witnessing some kind of driver shortage across all forms of transport.

There is a particularly severe shortage of heavy goods vehicle (HGV) drivers, a problem which intensified during the course of 2023 and shows no sign of abating anytime soon. According to research conducted by the International Road Transport Union (IRU), there are more than one million truck driver positions currently unfilled across the 36 countries, with these shortages set to double in severity by 2028.

A combination of technological advances and worsening driver shortages has brought the concept of autonomous HGVs into the conversation.

Assuming the technology works, or gets to a point where it works well enough, the case for driverless trucks is simple and compelling. They can transport goods between distribution centres, warehouses and other locations, thereby reducing the need for human drivers, especially on long-haul transportation routes where human labour shortages may be felt more acutely.

This could lead to reduced operating costs and enhanced productivity, as autonomous trucks can operate on a 24/7 basis without the need to take breaks, resulting in greater delivery speeds and reduced transit times. Furthermore, they can maintain a standardised driving style, leading to more efficient fuel consumption and less wear-and-tear on vehicles.

From a safety perspective, there also potential benefits associated with driverless trucking by removing the prospect of human error. Autonomous vehicles are programmed to follow traffic laws and react to hazards more quickly and consistently than human drivers, thereby reducing the risk of accidents.

However, there is always a counter to the argument, and in the case of autonomous HGVs, there are many barriers to entry at present.

Autonomous HGVs: Barriers to entry

Integration

Regulation

Infrastructure

Security

Are market forecasts too optimistic? Despite these concerns, market forecasters are estimating sizeable growth through the rest of this decade. Fortune Business Insights, for example, estimates that the global autonomous truck market will double in size by 2030.

And there has been a smattering of real-world tests being carried out by technologists and HGV OEMs. Scania, for example, began testing in Australian mining sites in 2018. The company’s owner, TRATON, was the first truck manufacturer in Europe to test autonomous transport between two hubs on public roads. The trial, conducted in partnership with control systems start-up TuSimple, involved two autonomous test trucks shuttling in regular delivery operations along 300 kilometres of the Swedish E4 highway between Scania’s plants in Södertälje and Jönköping.

However, more recent developments may dampen some of the optimism that has been building.

By December 2023, TuSimple indicated its intent to cease its US trucking activities after relations with truck manufacturer Navistar broke down, laying off a large proportion of its staff in the process. Waymo, owned by Google parent Alphabet, has also taken backward steps, halting its entire autonomous truck programme to focus on ride hailing opportunities.

Fleet operators on the frontline of supply chain and delivery operations also appear to be cautious.

DHL, for example, says that self-driving vehicles will;

significantly change the operational tasks performed by human workers and alter the way that customers interact with logistics providers in the last mile and elsewhere.

However, the company also states that realisation is “quite distant”, with the key challenge being to obtain societal confidence in using public highways. “It will take many more years before people trust fully autonomous technology and regulations permit unhindered application on a global scale,” the company adds.

It appears the sector has reached something of a crossroads, and it is difficult to tell in which direction developments will move, if they do at all. While the concept of autonomous HGVs has been around for quite some time now and entered many a conversation about the future of logistics, the immediate driver shortage will require other solutions in the short term. Longer term, the jury is still out.